At the end of the 2022-23 tax year, it is important for individuals and families to conduct a financial annual review. An ISA (Individual Savings Account) is a beneficial tool for saving tax on your investments. This article will introduce ISAs and explain how the Lifetime ISA can support you with your housing deposit.

Who needs an ISA?

An ISA is a type of personal savings account that is available for UK residents. One significant role of an ISA is that it helps you save on taxes.

All the benefits generated from investing in an ISA account will not be subject to capital gains tax, dividend tax, or income tax. Additionally, you do not need to declare these benefits in your tax return form.

If you use a general investment account instead of an ISA, you will need to pay capital gains tax and dividend tax when your investment benefits exceed the allowances.

For example, if you are a higher taxpayer, you are likely to pay 20% on gains from chargeable assets other than residential property which is taxed at 28%. Please consult professionals for details about your tax situation.

It is also important to note that since April 2023, the allowance for capital gains tax will be halved from £12,300 to £6,000, which will further decrease to £3,000 in April 2024.

The allowance for dividend tax will be decreased from £2,000 to £1,000 in April 2023, and then to £500 in April 2024.

This is why ISAs are so important for people who want to save on taxes.

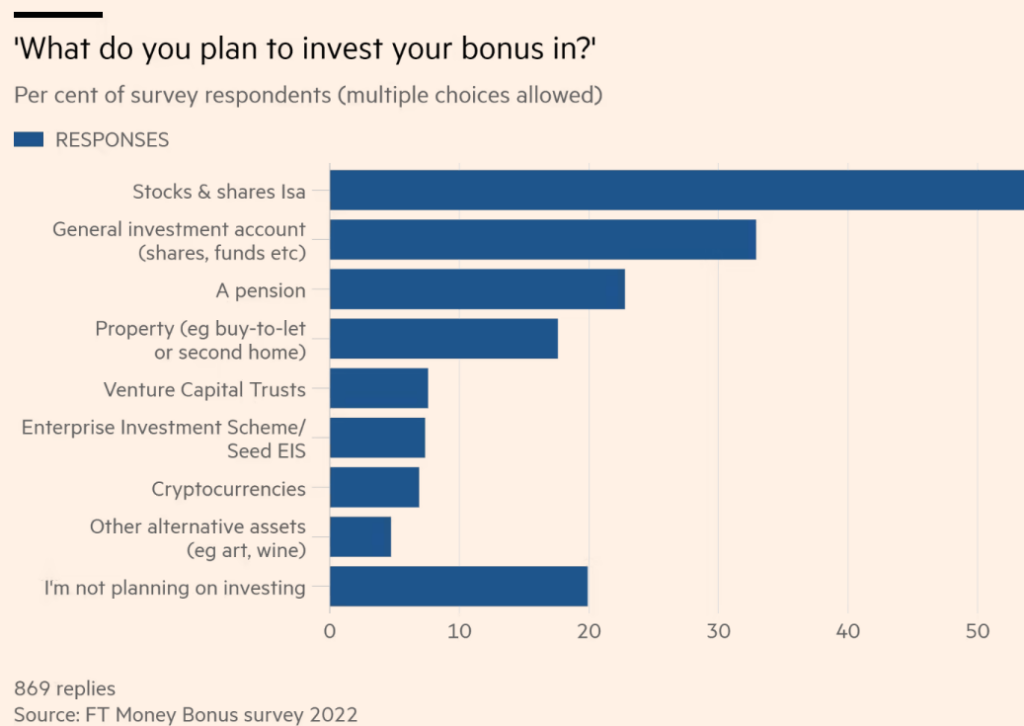

According to research conducted by the Financial Times last year on how people use their bonuses, 54% of people said that they would put part of their bonuses in their ISA accounts.

If you are a high earner, an ISA will be beneficial for your future investments.

What options do I have?

There are four types of ISA accounts:

- Cash ISA

- Stocks and Shares ISA

- Innovative Finance ISA

- Lifetime ISA

The total allowance for ISA accounts in a tax year is £20,000. You can deposit £20,000 in one ISA account or multiple ISA accounts.

Investors may deposit funds in their partners’ or children’s ISA accounts after filling up their own ISA. Junior ISA accounts are available for teenagers under 18.

Different ISA accounts are designed for various groups of people for different uses. Today, this article will explain how the Lifetime ISA can help you with your housing deposit.

What is a Lifetime ISA?

A Lifetime ISA (LISA) can serve as a savings pot for your first property and retirement.

You can deposit up to £4,000 in your LISA account. The UK government will top up 25% of your savings in your account every year. This means you can receive up to £1,000 in bonus from the government.

You can only set up a LISA account when you are below 40 and above 18 years old.

You can withdraw money from your LISA if you’re:

- buying your first home

- aged 60 or over

- terminally ill, with less than 12 months to live

You’ll pay a withdrawal charge of 25% if you withdraw cash or assets for any other reason (also known as making an unauthorised withdrawal). This recovers the government bonus you received on your original savings.

However, there are some requirements if you want to use LISA as housing deposits:

- the property costs £450,000 or less

- you buy the property at least 12 months after you make your first payment into the Lifetime ISA

- you use a conveyancer or solicitor to act for you in the purchase – the ISA provider will pay the funds directly to them

- you’re buying with a mortgage

Buying with someone else

If the person you’re buying with has a Lifetime ISA, they can use their savings and government bonus too.

They’ll pay a 25% withdrawal charge to use their Lifetime ISA savings if they own or have a legal interest in the property (for example, they’re a beneficiary of a trust that includes property).

If you are considering living in the UK on a permanent or long-term basis, a LISA can help you save for both your first property purchase and retirement. For instance, if you make deposits into your LISA account from age 18 to 50, you can receive an annual bonus of £1000, and a total of £32,000.

If you have any further questions regarding ISA and investment, please do not hesitate to contact Oceantide.

The value of investments can fall as well as rise, and you may not get back all of your original investment.

A pension is a long-term investment. The fund value may fluctuate and can go down. Your eventual income may depend upon the size of the fund at retirement, future interest rates and tax legislation.

Tax planning and Estate Planning is not regulated by the Financial Conduct Authority.

Approved by In Partnership, FRN 192638, 14/03/2023